A young person with a limited income now, but who has a high degree of confidence they will be earning much more in the near future, such as a medical student.A borrower with an irregular income, such as from a seasonal business, so they wish to be able to minimize payments when they wish, then make payments against loan principle when they are able to.Someone who only plans to stay in the home a few years before moving on, so they don’t want to tie up a lot of money in a mortgage.Here are some examples of the type of borrower who might benefit from an interest-only mortage: But you do have to begin making payments against principle eventually, so you need to plan accordingly. By requiring only minimal monthly payments, they’re a good choice for borrowers who don’t want to tie up a lot of money in a mortgage or for borrowers who want the flexibility to pay more or less each month as their finances allow.

Interest-only mortgages offer some significant advantages for the right kind of borrower. An interest-only calculator like this one can help you predict what those payments will be. However, after a certain length of time, often 5-10 years, you do have to begin paying down the balance on the loan. You don’t have to make any payments against the loan principle, at least not initially. About interest-only mortgagesĪs the name indicates, an interest-only mortgage is one where you only pay the interest charges. This will include the projected increase during the amortization phase of the mortgage, as you begin paying down the loan principal.

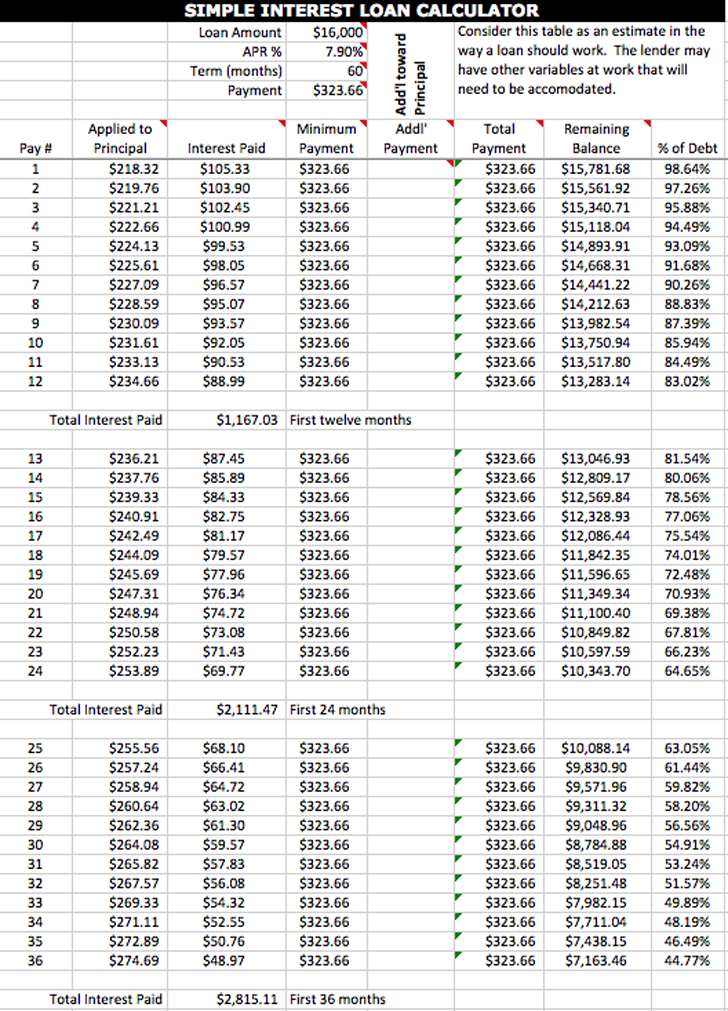

Then, click View Report to see how your repayment plan will look throughout the duration of your mortgage. When you click Calculate, you will see what your monthly payments will be during the initial, interest-only phase of the loan.

#INTEREST ONLY LOAN CALC HOW TO#

» MORE: Compare top mortgage refinancing lenders How to use the Interest-Only Mortgage Calculator Enter your information in the fields below, then using the sliding controls to experiment with how changing your prepayments, interest rate, length of interest-only period, etc. It will show you how much you can reduce your loan balance by making additional payments and the interest you can save by doing so.

This Interest-Only Mortgage Calculator is designed to help you figure out the costs and payments associated with an interest-only mortgage. For some borrowers, an interest-only mortgage can offer an attractive way to minimize their mortgage payments while preserving the option to make payments against loan principle when they wish. Why is the total interest higher than that of a standard mortgage?Īfter practically disappearing during the Great Recession, interest-only mortgages are making a comeback.Notes on the Interest-Only Mortgage Calculator.

0 kommentar(er)

0 kommentar(er)